Chennai Escorts

Call Girls in Chennaioversold vs overbought: What is the term OVERBOUGHT VS OVERSOLD says ? Ample Investment Adviser

Contents:

And to all those who are a part of this discussion…. This will really add to value to people like me who are need of quality analysis. I would say , better target for 25% return and not more and make strategy which is more worth and more probable to succeed . Please note that in cases 2 and 3 when I am not able to enter each month, I keep those Rs 100 in Fixed deposits, one my entry level comes so investment amount in all the 3 cases is exactly the same. Kept on buying every month until the PE was under 15. Re-entry only at PE at 11 and then buy every month until PE is below 15…and so on.

N-able Inc Shares Close the Week 21.0% Higher – Weekly Wrap – Nasdaq

N-able Inc Shares Close the Week 21.0% Higher – Weekly Wrap.

Posted: Fri, 03 Mar 2023 00:00:00 GMT [source]

I dont recommend Trading in short term using Nifty PE .. Its an indicator of people emotions and markets state for long term .. You need to see indicators which suits your Time frame ..

Market Dashboard

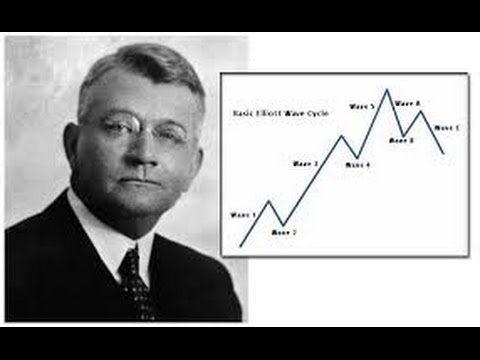

BankNifty daily chart indicates a failure swing, between 14 Sep 2022 and 20 Sep 2022. Let’s start with the Relative Strength Index or RSI, the three words that make this indicator. It is a momentum indicator which is the key strength of the price. RSI is therefore, directly proportional to the price, which means if the RSI increases, so does the price, and if the RSI decreases, so does the price.

- This does not imply that you should purchase the asset.

- Are you having any secret connection with IIM professors or any other financial Kings?

- On the other hand, RSI, or relative strength index is an indicator that helps you determine if a security is overbought, or undersold.

I am a learner and silent reader of jagoinvestor…..wish to get some more detailed discussion regarding “valuation of stock” or approach to pick promising stock. There are two reasons, I am a trader not an investor for long term . However, as an investor, knowing the meaning of RSI values can be very useful in avoiding misinterpretation of peaks as an upward momentum. You can measure A’s performance with it’s sector specific index, or even it’s market index.

replies on this article “Value Investing by using Nifty PE”

Although the RSI is an effective tool, it is always better to combine the RSI with other technical indicators to validate trading decisions and to reduce false signals. When a stock is in continuous downtrend, RSI will remain stuck in the oversold region as it cannot go below 0. Hence traders should not buy inspite of strong oversold RSI signal as the stock might keep climbing down following its downtrend. RSI) is a leading momentum indicator which helps in identifying the occurrence of a trend reversal or new trend in advance. The RSI provides a relative evaluation of the strength of a security’s recent price performance, thus making it a momentum indicator. While discussing some popular technical indicators earlier, we have briefly described the RSI indicator.

Here, the oversold vs overbought has to cross back below 70 after hitting the overbought territory first. Then, it bounces back and forms another high in the overbought territory. After which, it breaks its most recent low and to march into bearish territory. The below pictorial representation may help you understand the same better. Here, at the point marked with the crosshair, it can be seen that the RSI has clearly breached the upper limit, signalling severely overbought conditions and still, the price kept going up. No need to issue cheques by investors while subscribing to IPO.

OVERBOUGHT MOMENTS in Indian Markets

In principle, if a leading indicator offers the proper sign, a trader can get in before the market motion and ride the entire trend. However, main indicators are certainly not 100% correct, which is why they are usually combined with other forms of technical analysis. Before getting too enthusiastic about divergences as greattrading signals, it should be noted that divergences are deceptive in a strong pattern. A robust uptrend can present numerous bearish divergences earlier than a top truly materializes. Conversely, bullish divergences can appear in a robust downtrend – and yet the downtrend continues.

Hence taking any position based solely based on the Williams %R Indicator may prove to be more damaging than advantageous. There is not even a single article of your blog that I havent read…and my crave for more is increasing with each new BUZZ you send across. Your blog has inadvertently forced me to plan my financials. Thanks to your blog, I m no more a financial dumbo, who just invested into marketing gimmic of smart agents. But there’s a problem with the nifty link you’ve given for obtaining nifty PE’s. Its only giving the index value and not the PE – can you post the correct link please.

Technical Indicators

A https://1investing.in/ crossover happens when the MACD turns up and crosses above the sign line. A bearish crossover occurs when the MACD turns down and crosses under the sign line. Conversely, if the RSI is more than 70, it implies that it’s overbought, and that the value might soon decline. The 50 stage is the midline that separates the upper and lower territories. In an uptrend, the RSI is often above 50, while in a downtrend, it is below 50.

Since there is less power or support for the new higher price a reversal could be expected. This oscillator uses a similar formula to the Stochastic Oscillator. However, instead of comparing the closing price to the lowest price of a period, it compares the distance between current price and the current pivot point. By basing our oscillator on pivot levels, we incorporate a much more relevant and…

- You may have to use other technical analysis tools and keep an eye on the price chart closely here.

- It allows us to define overbought and oversold zones by compressing the values of the “fisher transform” indicator between 0 and 100.

- After having poured over the technical indicators, its time we traverse to Order & Trade book data.

- We will see very shortly, why RSI is a momentum indicator.

- The subsequent chart exhibits Google with a bullish divergence in October-November 2008.

The Mobility Oscillator was created by Mel Widner and this is another of my ongoing series of undiscovered gems. I would say this is probably the most complicated script I have written for an indicator. It is extremely complicated to calculate comparing to other indicators but this is essentially an overbought and oversold…

Relative Strength Index (RSI) – Why RSI Divergence, Overbought, & Oversold Conditions Fail Terribly?

At the same time, MACD is more versatile – it can be used to gauge trading signals in wider and more different timeframes. MACD also produces more frequent signals than RSI. Here, when an RSI trendline breaks, it could indicate a trend reversal or price continuation. A bullish failure swing forms when the RSI goes below the 20-level mark. It then comes back to go above 30, then forms another dip coming back into the oversold territory and finally breaking its most recent high.

If underlying prices make a new high or low that isn’t confirmed by the RSI, this divergence can signal a price reversal. If the RSI makes a lower high and then follows with a downside move below a previous low, a Top Swing Failure has occurred. If the RSI makes a higher low and then follows with an upside move above a previous high, a Bottom Swing Failure has occurred. No worries for refund as the money remains in investor’s account. Similarly, negative divergence is evident in the above chart, where prices scale a new high, but MFI scales a lower high, as shown by the two orange lines which diverge. These charts can be easily view through Quantsapp web app and mobile app also.

When the ADX line is rising, trend strength is increasing, and the price moves in the direction of the trend. It is a momentum oscillator that takes the current price and compares it to a price “n” periods ago. The ROC is plotted against a zero line that differentiates positive and negative values. Buy or sell the stock when an RSI overbought or oversold signal is combined with a supportive crossover of the moving averages.

Strategy charts help in understanding option premium dynamics of a particular option strategy. Now its time for some technical indicators which work well on the underlying and option charts alike. This blog is about the world’s most misunderstood Indicator. Relative Strength index is an Indicator that almost everyone uses.